May 23-25, 2023

Qatar Economic Forum

The global economy faces unique uncertainties. China’s reopening is set to provide a welcome boost to global growth, offsetting weakness in Europe and a lingering recession risk in the US. But China’s post Covid pivot could bring inflationary pressures at exactly the moment the US Federal Reserve and other central banks are bringing them back under control.

Look beyond China-US-Europe centric headlines, however, and you can uncover a major shift in the existing economic order: In a world defined by a 19th century-style battle for resources, more assertive economic statecraft and an eagerness for more resilient and geopolitically neutral trade partners, the economic nexus between the Gulf, India, and Southeast Asia is rising in global importance–and looks set to drive global growth and optimism into the next decade.

In the Gulf, Qatar and its neighbors are capitalizing on the opportunity. The region’s sovereign wealth funds, flush with oil and gas revenue from the energy crisis, are competing to fill the $3 trillion liquidity gap left by Wall Street’s retreat. And with global supply lines rerouting and the epicenter of global growth shifting Eastward, the Gulf is increasing the pace of reforms and opening up to meet the world on its terms.

Against this backdrop, the 3rd Qatar Economic Forum, Powered by Bloomberg, will shine a light on the rising south-to-south economy and the new growth opportunities it presents to the global business community. Promoting both established viewpoints and emerging voices from around the world, the Forum will identify the latest economic trends that will drive us towards a new global growth story.

2023 Featured Speakers

The forum features a curated group of global leaders and innovators exploring solutions for some of today’s more pertinent challenges as they draw up a blueprint for our shared future.

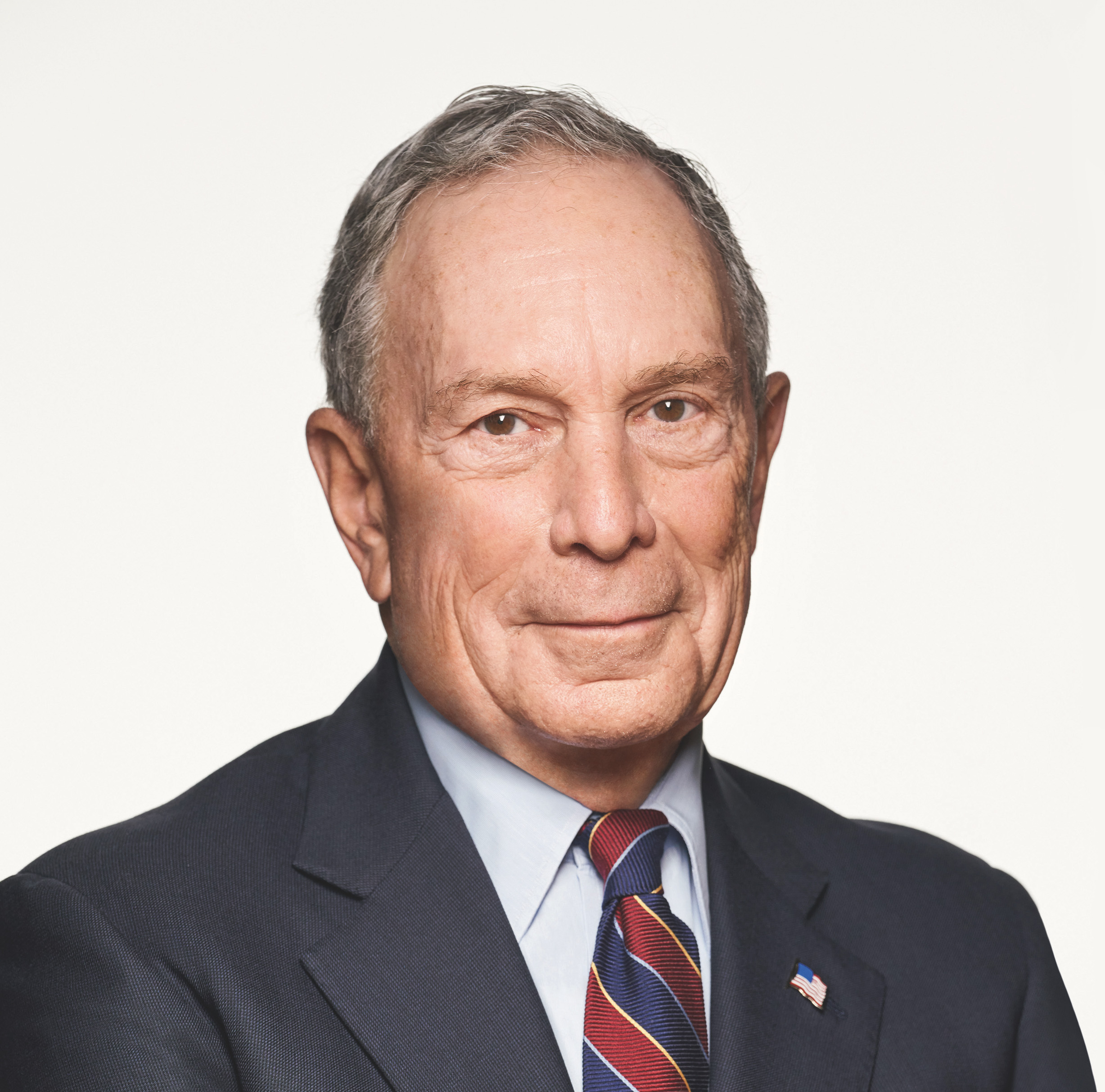

Michael R. Bloomberg

Founder, Bloomberg LP and Bloomberg Philanthropies

Ursula M. Burns

Founding Partner, Integrum Holdings Chairman, Teneo Holdings

Shou Chew

CEO TikTok

H.E. Mohammed bin Abdullah Al-Jadaan

Minister of Finance Kingdom of Saudi Arabia

David L. Calhoun

President & CEO The Boeing Company

Dina Powell McCormick

Vice Chairman, President & Global Head of Client Services BDT & MSD Partners

Kristalina Georgieva

Managing Director International Monetary Fund

Marcelo Claure

Founder & CEO Claure Group

Peter Chernin

Co-Founder & Partner TCG

Divya Gokulnath

Co-Founder & Teacher BYJU's

Stephen A. Schwarzman

Chairman, CEO & Co-Founder Blackstone

Ola Doudin

Co-Founder & CEO BitOasis2023 Themes

The Gulf-India-Southeast Asia Economic Nexus

Can this regional power nexus drive global growth into the next decade? What investment opportunities will it present to global business?

Managing Inflation

How can we manage inflation and boost long-term productivity, economic growth, and worker salaries without triggering a deep and prolonged recession?

How to Invest in Emerging Markets

Where should investors look for growth in today’s volatile global markets? What are the best emerging market strategies?

The Future of Globalization & Global Trade

How are shifting geopolitical interests changing cross-border trade?

The New Economic Statecraft

How will south-to-south direct trade evolve in a world defined by more assertive economic statecraft and a shift away from globalization?

The Energy Transition

How can we get the global green energy transition and sustainable business efforts back on track and avoid the worst climate change scenarios?

A.I., Web3, & The Dawn of the Metaverse

How will artificial intelligence, the blockchain, the metaverse and other technologies combine to revolutionize the ways we trade, work and play?

The Business of Sports

How can we maximize the business potential of global sports while protecting the spirit of the games?

Key Stats

9 Heads of State

8 MOU signings

150+ Bilateral meetings

6,000+ Press mentions

149 Countries represented

250,000+ Livestream views

Video Highlights

Press Highlights

The 2023 Forum garnered over 5,000 headlines and mentions in global news outlets. Some of the top headlines include:

- Al Arabiya: Georgia PM says cannot afford sanctions on Russia, would ‘devastate’ economy

- Doha News: TikTok CEO takes on AI technology at QEF

- Al Jazeera: Hungary’s Orban says ‘poor Ukrainians’ cannot win against Russia

- AllAfrica: Rwanda: Kagame in Doha for Qatar Economic Forum

- Daily Mail: Qatar Airways CEO doubts 2050 net-zero goal can be reached

- Al Jazeera: ‘Where is the logic?’: Georgia will not sanction Russia, says PM

- Doha News: Ghana secured $3bn in funding from IMF: president